Contact

LinkedIn

Copyright © 2024 PIKON International Consulting Group GmbH

Home » Services » SAP Add-Ons » Add-On: Integrated MTD – VAT Connector for SAP

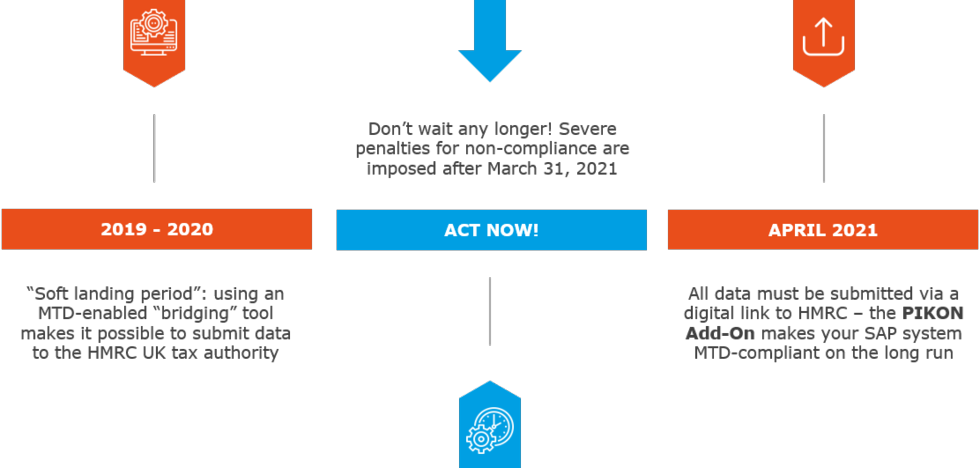

VAT periods beginning on or after 1st April 2021 must be submitted via MTD.

With their Making Tax Digital (MTD) initiative, HMRC (His Majesty’s Revenue and Customs – UK tax authorities) have set their intentions to become one of the most advanced tax authorities in the world by enhancing the customer experience whilst also closing the tax gap.

The primary aim of Making Tax Digital is to make tax administration more effective, efficient, and easier for taxpayers through the implementation of a fully digitalised tax system by 2021, whilst also reducing HMRC’s overheads for managing tax affairs.

From April 1, 2022, ALL companies that generate taxable sales in Great Britain are obliged to submit sales tax returns via a “digital link” to the tax authority HMRC. The previous sales threshold of £85,000 will no longer apply!

From a practical point of view, MTD for VAT requires businesses to keep digital records and accounts, which needs to be digitally linked – including all data transfer or exchange within and between software and applications. MTD mandates the use of functional compatible software, such as SAP ERP, to meet these requirements that must connect to the HMRC systems through APIs (Application Programming Interfaces). In order to comply with this mandatory requirement, PIKON have developed their “Integrated MTD-VAT Connector” for SAP.

Request a web-meeting with a demo and we will explain you our approach to make your SAP ERP system MTD compliant with our solution “Integrated MTD-VAT Connector for SAP”.

You are currently viewing a placeholder content from Youtube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationThe Integrated MTD-VAT Connector for SAP calculates and submits VAT returns directly from SAP ERP (either SAP ECC or SAP S/4HANA) to HMRC via a digital link to the MTD platform. Because of that, it ensures a seamless digital journey for your UK VAT fillings and runs over SAP ERP as an end-to-end solution. This solution is fully integrated in SAP without an external interface or use of external software and SAP ERP release independent. It contains user-friendly screens, owns customised tables and owns transaction codes and menus.

The SAP Integrated MTD VAT Connector meets HMRC’s legal requirements, is easy to use, quick to implement and easy to maintain.

With PIKON as your partner to make your SAP ERP system MTD-VAT-compliant, you can be assured of the following:

System Requirements

The basic price consists of the licence list price (one company code included) and a surcharge per additional company code that has to be reported.

An annual maintenance fee is charged for maintaining functionality in the event of updates on the part of both SAP and HMRC.

Please fill out the form to find out more about the pricing and/or get more information.

For more information about PIKON’s MTD solution, or if you would like to arrange a web meeting including a system-demo with our MTD team to discuss how PIKON can help you to fulfil your MTD obligations with SAP, please fill out the form:

Register for a free and non-binding PIKON newsfeed here and receive our latest blog posts with expert knowledge on digitisation and SAP topics by email once a month. After your registration you will receive an email in which you please confirm the link once again (double opt-in procedure).